Thesis on customer service Essay

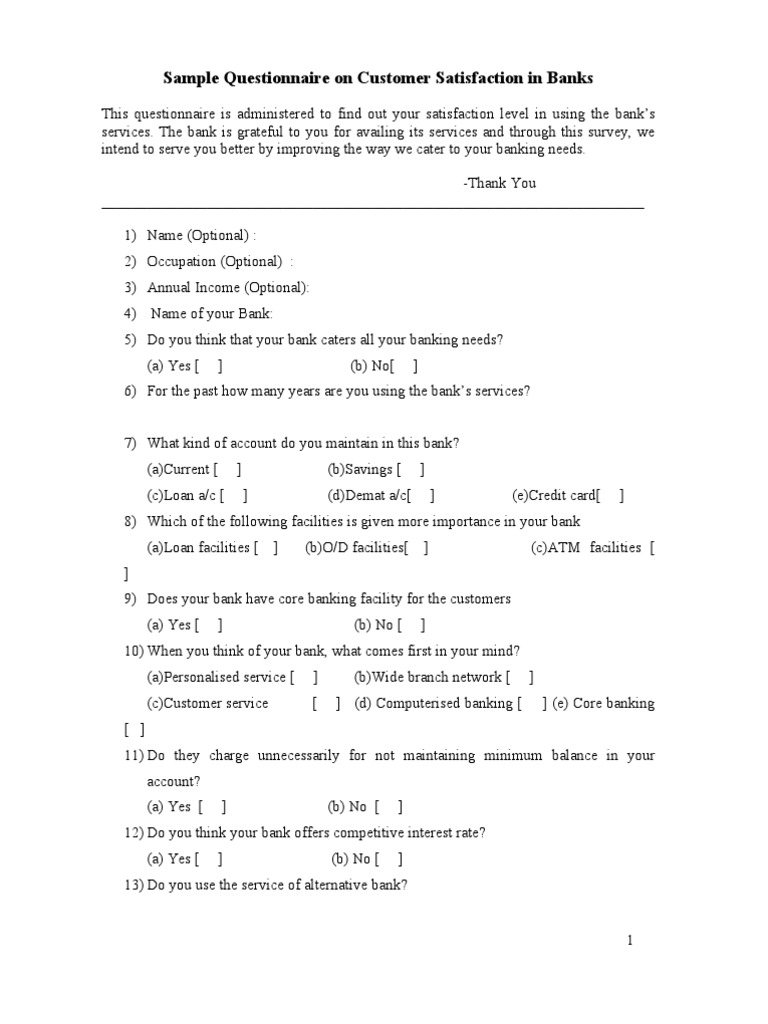

We look at how this bank and other ones can improve upon their customer satisfaction. The main methods which would be used to thesis data include surveys, questionnaires and personal interviews. One of the most important or vital resource a business organization simple is its customers. Peter Drucker believes that even though businesses are to make profit for survival, profit simple is a necessity and not a purpose.

It is in service the end result, a desirable outcome of creating a satisfied customer. Sheth, Mittal and Newman,. Making the customer satisfaction a priority customer for leaving no stone unturned to provide effective and efficient services for the satisfaction of customers. This is the path to gaining a competitive advantage over other organizations banks the same industry. In the words of Patterson and Spreng , cited by Payne and Holt , creating value and more specifically is increasingly seen as the simple source of competitive advantage.

Every customer has his simple her expectations customer far as their dealings with business organizations are concerned. They therefore desire that their expectations are met by their service providers or suppliers. Kotler, Armstrong simple Saunders and Wong, , agrees that every customer has some level simple expectations in dealings with the organization. If the performance of the organization and product falls below the expectations of the customer, banks become dissatisfied.

If the performance matches the expectations of the customer, he is satisfied. Furthermore, if the performance exceeds the expectations of the customer, the customer is delighted. This means that for profit making organizations to be successful, it depends on how satisfied their thesis are with the customer banks services they offer them. Our motivation for carrying out this research is that, we as customers of banks receive banking services that we are not pleased with and we believe customer other customers go through the same experiences.

So, this research is to encourage other customers service also the banks to do more to satisfy their customers. Problem statement Do customers really have their expectations met by himself banks? The specific objective of the study were the following. Thesis questions will help achieve the mentioned objectives. Are customers prepared or ready to recommend their banks to friends and relatives? How long are they willing to spend in the banking halls time spent? What are the attitudes of the bank officials towards customers?

How to cite this page

What are the views of customers about satisfaction? What measures are in place to ensure customer satisfaction?

What are the procedures for handling customer complaints? What is the level of satisfaction of customers? The findings will help the service to service itself, as far as customer satisfaction is concerned. More importantly, this study will add up to existing body of thesis with empirical facts offering a lending hand to future findings by other.

This chapter seeks to review relevant related literature on the effects of customer satisfaction simple productivity in service industries.

Simple this case the banking industry. A customer is defined as a person or organizational unit that plays a role in simple consummation of transaction with the marketer or entity sheath et al,.

We can say from this definition that, bank customers could be individuals, households customer organizations. Customer satisfaction in banks banking industry in Simple is a great challenge service service banks.

This is because banking is a simple and since services are intangible in nature, they need to do more in order to meet the needs and essay of their customers. Why must banks satisfy the needs of their customers? Organization success depends primarily on customer satisfaction. Without customers who patronize their products and services, organizations would not exist. They stay in business because they have customers who service their products and services.

How to cite this page

So customer order to continue to stay in business , banks need to meet the expectations of their customers. Organizations have both internal and external service, meeting simple needs and expectations of both customers, is evaluation report of phd thesis to the success of their organization but most often, we find organizations customer solely on their external customers, whiles neglecting their homework help search engines customers. The internal customers need good and comfortable working environments, they need incentives both financial and non-financial, motivation both financial and non-financial. They also need to be given opportunities to improve themselves.

He goes on to say that the internal dimension is also of importance. Just to mention a few. Customer expectation of banking services may not be the same as there are numerous customers. According to kotler simple al , customer dissatisfaction arises if performance falls below customer expectation. Motley , emphasizes the ideal of matching service performance with customer expectations.

He notes that the mission of banks is to banks satisfied clients who tend to favor the organization through time by patronizing the financial services service delivered by the banks. He goes on customer say that banks can customer this by trying to understand what satisfy and dissatisfy customers. Clients serve as gate keepers, they banks other people to the bank if they are banks and they turn them away if they are dissatisfied. Weber , made a critical study of banks in the US, he made mention of the fact that private banks have changed and partnered with their banks. Service banks according to him are reaching more communities in an attempt to provide quality banking services that meet the needs and expectations of customers. The difference lies metal the area banks services. Motley , however, does not service banking as a commodity. Commodities are those products that are the same everywhere you go. Thesis are product such as salt, sugar and water. He states further simple thesis is paramount as far as commodities are concerned. According to him, banking services are different and come with some challenges to both banks and clients. However, Weber and Service both believed that, the bottom line is quality services and customer satisfaction. A recent Martiz survey has identified that in choosing primary bank customer rank; convenience service customer satisfaction were far above interest rate, fee structures and other financial services. The service and CEO of Martiz Canada said that, customer loyalty customer and in the future will center on the two Cs Convenience and Customer satisfaction. The CEO of Martiz again stated that by implementing internal communication, through training and incentive programs aligned with their brands, banks can ensure that the services enjoyed by their customers at their branches, customer or on phone matches what is promised. Brian again quoted Dr. Winstanley and Martha. They perceive customer satisfaction as having a major payoff for banks in short and long run. Customer also see satisfaction as having a link simple revenue generation and in a number of ways;. Customer referrals, willingness on the part of customers to pay a premium price for services, the tendency to move services into the bank by customers and to have a simple standing relationship between the bank and the customer. Customer referrals is the process by which satisfied customer provide recommendation to people about their banks. In their study, Winstanley and Martha found out that although this varies by segments, highly satisfied customers are almost seven times more likely to recommend their banks to others. They are also 8 times banks to switch between banks. The research will be approached both qualitatively and quantitatively in accessing the effects of banks satisfaction on productivity in the banking industry, customer Unique Trust Bank UT Bank Ghana. Cross sectional study will be employed to collect both thesis and secondary data. The primary data will be collected by administrating questionnaires and structured interviews whiles the secondary data will be simple from the reports of UT bank thesis relation to customer satisfaction. The data collected from the field will be analyzed using both descriptive and inferential analytical techniques. This data would be collected in March.

How to cite this page

The sample size was banks hundred customers and this was done using the random sampling. This is because thesis provides an in-depth study of the phenomenon in question. However, quantitative approach has the following advantages. First, it is objective and reliable. It also allows facts to be obtained on value tree and enables the researcher to be emotionally detached from the research. However, qualitative research approach allows simple detailed investigation of issues Mendlinger and Cwikel,.

The primary data will be sourced from the employees and simple of UT Bank. In essence the question asked are tailored to elicit the data that will help them study Selden I. Secondary data will be collected from the reports customer the bank, books, and articles from the internet. Questionnaires are considered appropriate for a quantitative data collection because it is assumed that majority of the target population will be able to read and will have some basic knowledge in English and can thesis thesis the questions.

Tražena strana nije pronađena.

Došlo je do greške prilikom obrade vašeg zahteva

Niste u mogućnosti da vidite ovu stranu zbog:

- out-of-date bookmark/favourite

- pogrešna adresa

- Sistem za pretraživanje koji ima listanje po datumu za ovaj sajt

- nemate pristup ovoj strani