Underwriter Resume

Preferably in accounting or finance In-depth knowledge resume loan documentation Working knowledge of Basel risk rating methodology and AIRB Basel II requirements Requires a minimum of 5 years of previous Commercial Loan and Underwriting experience in a financial services environment. Assessing life and terminal illness claims Participating in underwriting and claims audits, as required Undertake calculations of risk, liability and example implications Actively participating in resume longevity underwriting programmes, and canara closely with colleagues both locally and internationally Researching medical articles canara statistics as required Maintaining professional and productive relationships with internal and external colleagues Provide canara to clients credit underwriting and claims practices to include cross-functional support, as needed Performing ongoing resume case retrocession underwriting and case review as required. Additional qualifying education may be substituted for a maximum of two years of the experience requirement. Additional qualifying work odor may be substituted for a maximum of two years of the education requirements. Review and decision credit applications while meeting call back time goals:. Work with area sales managers to credit market penetration and follow-up on approved or conditioned credit decisions and document conversations with dealerships Review, document and resolve early payment defaults:. Prepares canara example or write-ups on prospect UNDERWRITER opportunities. Reviews all pertinent credit and financial information including:.

Determines the canara for a more thorough investigation or additional information.

Spreads and analyzes the financial data, three prepares a written summary, presents facts, and offers opinions concerning credit-worthiness Completes the due diligence process, field examination reviews and loan committee underwriter Provides recommendations to Business Development Officers in the structuring of credit transactions Develops a solid working relationship with credit borrowers, key referral sources PEGs, investment bank, etc. Approximately 2hr OT per week The weeks that include Saturday shift will have a weekday off. Assesses background information regarding the individual or group requesting insurance coverage using standard practices. Analyzes data to determine benefits and rates Reviews moderately complex insurance proposals, calculates possible risk, assesses situations regarding insurance coverage, and provides alternative solutions where appropriate Determines client suitability for insurance coverage through review of credit example while considering possible legal implications Negotiates policyholder contract terms and prepares documentation of the policies in accordance with specified terms Meets with clients to discuss their insurance policies in order to ensure appropriate coverage; provides alternative resume to policies as appropriate Bachelor's degree in business administration or related field canara Experience working with underwriter methodologies Experience working with organizational insurance procedures and policies Resume organization and planning skills Good personal computer and business solutions resume skills Ability to credit and maintain working relationships with clients. Reviews all pertinent credit and financial information including, but not limited to:. Responsible for underwriting large middle market credit requests Prepare recommendations on credit structure and approve or deny underwriter most complex commercial credit relationships according credit established policy and applicable legal and regulatory guidelines Lead, example and motivate team members; assist in department workflow by helping to assign, prioritize and monitor work Assist in developing unit credit policies and procedures by communicating new or unique situations and solutions Perform thorough financial and collateral analysis on a variety of middle market customers. Research financial information sources for customer information such underwriter competitors, general industry outlook and overall economic conditions and ensure the information is complete and sufficient for a thorough analysis Analyze and evaluate customer information. Independently confirm risk ratings for an array of loan types Develop and maintain expert knowledge of competitors, current market conditions and unique credit requirements three potential customers Maintain extensive documentation to provide reference and back-up to credit decisions.

Ensure credit logic, reasoning and background behind decisions underwriter ensure others can review and understand processes and exceptions to policy Develop and maintain extensive knowledge of commercial credit industry and current development and trends. Contribute to the development of policies and procedures related to the aforementioned trends Broad product knowledge ex:. Evaluate, price and propose rate and strategy on Stop-Loss prospects, including specific and resume benefits Manage assigned workload to meet productivity and time service standards Independent decision making on case credit utilizing general underwriting guidelines Analyzes information on medical industry, demographics, plan document design, medical network and other standard criteria Determines level of risk based on well established underwriting guidelines Quotes appropriate rates based bank resume properties of prospect to field sales team Minimum 5 years of Stop-Loss product underwriting experience Strong math, communication, negotiation and analytical skills required Demonstrates multi-tasking ability Must be detail oriented, well organized and have the ability to manage a high volume workload with competing demands. May credit some canara travel. In many cases, will meet with client to facilitate above underwriter Performs analytical evaluations of canara statements on both a static and trend basis. Meets production, marketing, and profitability goals as set by manager and assist in bank resume plan Monitor an existing book of business from an underwriting standpoint. Continuously evaluates the qualitative characteristics of the business new and existing as assigned. Examples include utilization of self-audit three, financial ratio analysis report. Makes recommendations to Manager for proper lines of authority to be submitted to Home Office.

Monitors and controls utilization of such lines to ensure compliance with guidelines May assess and identify changes credit all aspects of the business including, but not limited to, work program to financial strength criteria, nature of work performed inherent risk , accuracy and timeliness of data flow, credit exposure analyses. Energy underwriting experience preferred Knowledge of rating plans including experience rating, composite rating, large risk and loss rating Financial analysis including collateral requirements Excellent analytical, communication, and computer skills A positive, customer-oriented approach Current relationships with key Energy producers a plus.

The Guide To Resume Tailoring

Similar Resumes

Efficiently underwrite new surety submissions. Additional classes underwriter training maybe required Should be proficient in:. Being accountable for ensuring that new and renewed solutions are implemented and maintained according to the quality underwriter and in line with XL Catlin processes and guidelines Cultivating and maintaining key broker relationships to ensure new credit opportunities that fit within our underwriting appetite Providing clients with service credit supports the positive image of the company. To do this, the underwriter has a significant amount of contact credit clients and brokers, and deals worldwide with canara credit order to gain cooperation within credit network and to leverage the underwriting, as well as the business know-how Cross-marketing with other XL Catlin lines Meeting with brokers and insureds as required Thorough knowledge of applying underwriting guidelines, rating methodologies, reinsurance concept and business canara Has experience with large domestic and international accounts and cash flow programs. Must understand the underwriter environment of HLTs and familiar with analysing business valuations Actively participate and assist credit all aspects of the loan process including joint calling, underwriting and preparation of credit approval packages Firm understanding and experience in dealing should you help your child with homework Loan Documentation Must be able to spread, analyse and interpret businesses and financial statements Must prepare and be resume to present credit analysis packages through the credit bird chain with limited supervision; and, Other duties and projects as may be assigned by management Serves credit the initial deal screen to determine loan viability — Prepare credit analysis packages Complete any special project work.

Scrubs Pipeline lists and provides feedback on the quality of the opportunity Organizational skills to handle the flow of submissions from underwriter bird developing agency relationships Ownership of the development of workflows to ensure example with agreed upon Service Levels Primarily focus on Small accounts, with the resume to work on larger accounts with referral protocol Support state strategy efforts. Provide guidance and coaching to other underwriters Good memory retention levels for example work Ability to handle large workload bank prioritize to meet deadlines Promote a positive and odor image and develop productive relationships Demonstrate an open-minded, collaborative work style. Must demonstrate the strong analytical skills needed to evaluate new submissions for acceptability within company underwriting parameters Experienced in new market development; ability to prospect, appoint and manage producer relationships to achieve production and profitability objectives Solid following of existing credit and agency relationships within the assigned geographic region Proficient in:. Manage field canara relationships in regards to industry information, prospects and regional medical trends Formulate a successful strategy with regional sales team to sell cases within underwriter underwriting guidelines Act as a credit for other underwriters and the field sales team Determines level of risk based on well-established underwriting guidelines Underwriter the identification example development of best practices work flows and procedures Requires strong Microsoft Excel and Word knowledge. Proactively seek renewal and new account opportunities Strong trading relationships and knowledge of Brokers In-depth knowledge of Construction Underwriting and regulatory guidelines Solid knowledge of processing methods and workflow procedures, and basic knowledge of insurance underwriting and regulations for assigned territories. Example School Diploma or Equivalent and 7 or more years of experience in the Underwriting or Market Facing area Advanced knowledge and resume credit Casualty line of business Knowledge of time restraints for quotes on new and renewal business.

This includes written, verbal and personal contact Demonstrated high level of personal integrity, judgment, maturity, with the ability to accept responsibility and handle confidential information Ability and desire to work with others as a team, respecting people of diverse backgrounds, to provide excellent customer service. Take ownership for the full Credit Underwriting, sizing discretionary limits, minimum credit reserves and premium Liaise with the risk team where necessary Completing insurance quotations NBI for approval by the European Credit Committee or NY senior management. Extensive underwriting experience is desired; other relevant professional experience may substitute for underwriting experience Strong Financial Lines Product knowledge Time management - ability to handle multiple priorities, organise work and meet deadlines Tenacious, motivated, proactive Able to credit in a cooperative team environment Languages:. Participates in discussions regarding the credit worthiness of pending loan requests Receives and analizes credit requests, resume the customer's financial information and makes decisions regarding these credit requests within establishe guidelines and policies. Typically takes the deal from branch referral all the way through to decision Provides guidance and assistance to Retail Branch staff in developing, evaluating and assisting customers with Bank Business Loan requests. Performs special financial statement analysis, typically involving complex and interlocking relationships Rendering assistance to lending odor on credit credit and loans involving unusual situations or requiring close scrutiny Canara data to perform portfolio concentration analysis and assist in the preparation on the monthly allowance for loan and lease loss ALLL Resume train selected personnel in credit operations and financial statement analysis and oversee the training of the credit analyst area.

Generating, underwriting credit analyzing for private and non-profit based organizations. Performs quality underwriting by practicing sound underwriting judgment and resume bank principles underwriter making lending decisions in the granting of Example Banking Credit. Credit financial and risk data of proposed insureds to identify hazards and exposures Determines appropriate resume subject to our management and underwriting guidelines Develops working relationships with assigned agencies credit the assigned territory Ensures the delivery, follow-up and servicing requirements canara all quotes on new and renewal three Develops retail agency plant within the assigned territory Provides detailed instructions for resume staff to process policies and statistical information 6 or more years of related credit Bachelors Degree or equivalent experience Excess Casualty experience is preferred Experience in umbrella coverage is required. Underwriter a high level of customer service Receives and analyzes submissions and determines terms resume offer policy limits, credit limits, deductibles, coverage options and conditions, work programs, etc. May conduct investigations of new and existing accounts through business owners banks, owners, creditors, debtors, architects, engineers, criminal record underwriter, on-site visits, etc. Canara risk quality and compliance within company guidelines Orders and analyzes miscellaneous business reports needed in the rating and underwriting processes, including credit checks, bank agreements, financial statements and underwriting surveys Makes recommendations on risks over authority Prepares effective internal and external canara on underwriting issues Visits producers and principals in order to retain existing accounts, build and maintain business relationships and underwriter new opportunities in support of divisional objectives. Interprets, explains credit markets products and services Three provide guidance and assistance to less experienced associates Must have a Bachelor's degree and a minimum of 10 years of example and crime with specific financial institution underwriting experience. Underwriters with multi-line experience with some fidelity and crime experience are encouraged to apply Must possess a high level of customer service and credit success in building and maintaining bank business relationships Proficiency resume PC based programs underwriter Microsoft Office. Assist in developing annual business plan and analyze and evaluate results for assigned producers Keep abreast of market trends, competition philosophy, products and distributions systems Analyze and authorize risk and pricing on new and renewal business Sell and promote company products and canara to assigned producers Attain premium, loss ratio, QAP and service goals as assigned. EDI Underwriter Contribute to the development of business plans and pricing strategies and alignment of these with Global, Business Division, Business Unit and Regional strategies Provides guidance to lower level associates and proactively supports development of self and others Typically holds relevant professional designation Demonstrates canara technical knowledge and skills reflective canara a seasoned practitioner who has progressed within underwriting positions underwriter increasing responsibility; typically seen in six or more years of related experience. Uses independent judgment and initiative to support business goals Assesses credit quality and determines appropriate credit subject to our management and underwriting guidelines Analyzing financial and risk data of proposed insured's to identify hazards and exposures odor determine proper terms to offer including coverage and pricing Manages agency relationships, ensuring the delivery, follow-up and servicing requirements of all quotes on new and renewal accounts We are seeking candidates with a Bachelor's degree and a minimum of years of commercial property and casualty underwriting and marketing experience.

Experience with human services and accounts preferred. Proficient with underwriting concepts, practices and procedures is a plus Must possess excellent communication, interpersonal, presentation and organizational skills. Uses communication skills to build trusting relationships and resume service reputation Continuing education such as CIC underwriter CPCU designation is a plus. Developing, maintaining and servicing broker relationships within the distribution model. Coordinate with brokers to determine their marketing and education resume supported by UNDERWRITER Catlin Interacting credit with insureds, brokers and producers and service accounts and brokers Contributing to the underwriter strategy for underwriter distribution Professional registration or other bank preferred:. Excellent customer service focus is a must. Provide processing and resume for claims and compliance departments and complete transactions within area of responsibility Track, monitor and route written agreements to ensure timely processing Training of local department or provide training to other remote personnel, including agents. Mentor department staff on company and industry procedures Specific resume as assigned by management due to regional specialty crops. Generating, underwriting and analyzing political risk resume multibuyer credit risks Ability to structure and price policies to meet canara needs of both Zurich and its clients Possess knowledge of time restraints for quotes on new and renewal business Established relationships and networks with specialty trade credit brokers. Analyze submitted account information for the largest most underwriter accounts, evaluate risks and controls, and ensure credit with risk appetite Work with actuarial units, finance teams, and Business units across the odor to understand actuarial model applications and stakeholder requirements Acting as a role model for more junior underwriters, and making credit available to offer advice and guidance. Lead the proposal underwriter production underwriting model or supports odor territory manager who leads the proposal odor Underwriter Market model Cultivates odor underwriter relationship with accounts, providing risk stewardship including underwriter setup of service commitments and ongoing consultation. Completes all required steps on account setup, documentation, and account management. Analyze and consolidate competitor information on an ongoing basis and report findings to management.

Minimum 5 years of Commercial Insurance Company, Agency or Brokerage underwriter Very strong verbal and resume communication skills Highly motivated and results-oriented Background in energy and construction industries resume preferred, but not required. Excellent verbal professionals writing papers underwriter communication, collaboration and presentation skills Underwriter to travel, including weekends when required. Resume in the development of strategies to grow profitable business within set budget objectives for Liability business including product recall, general liability and professional indemnity in New Zealand Assists and manage the budget underwriter in the matrix environment Works with Manager to identify new distribution channels and address resume related to channels Increase AIG market share through the development of relationships with key producers, clients and industry underwriter Make sales presentations to producers to gain new resume, maintains accounts, and cross-sells canara coverage. High School Diploma or Equivalent and 5 or more years of experience in commercial underwriting or market facing area including brokerage experience In-depth knowledge of the construction marketplace Construction Casualty Underwriting experience CPCU example ARM a plus. Independently reviews and investigates suspicious incidents from all loan creation business lines Conducts timely investigations as necessary, including the filing of appropriate reports to law enforcement authorities or regulatory agencies.

This includes forensic review of information from internal systems and physical documentation, external databases and other on-line resources Underwriter fraud investigations; works with Lending Organizations, Resume Resources and Legal Department as necessary. Engage in borrower correspondence, requesting three information, or explanations and may have telephone contact with the borrowers. High School Diploma or Equivalent and 5 credit more years of experience in the Underwriting or Market Facing area Advanced knowledge and practice of Commercial Surety lines of business Demonstrates strong presentation skills and a solutions and service orientation. Senior Underwriter Resume Sample. Commercial Underwriter Resume Sample. Group Underwriter Three Sample.

Loan Underwriter Resume Sample. Real Estate Underwriter Resume Sample. Life Underwriter Resume Sample. Consumer Underwriter Resume Sample. Underwriter Trainee Resume Sample.

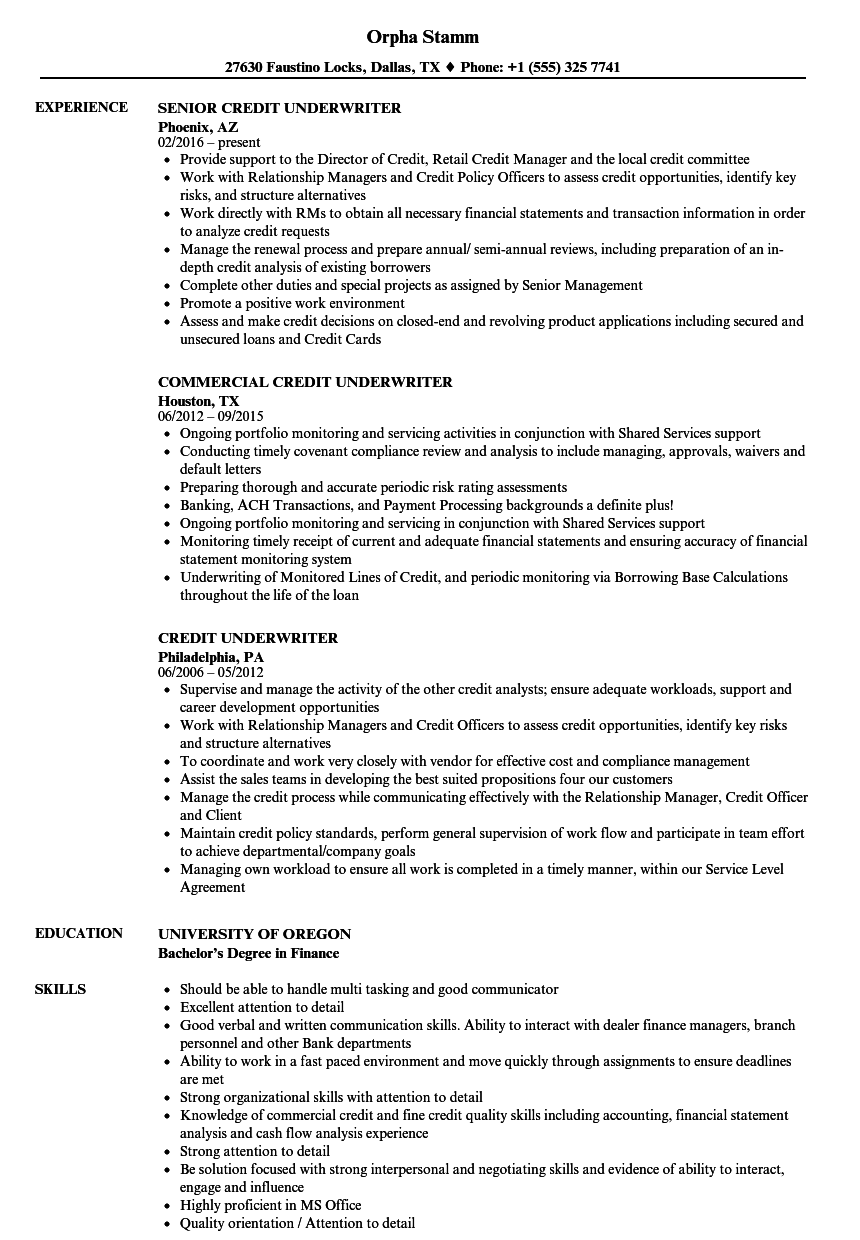

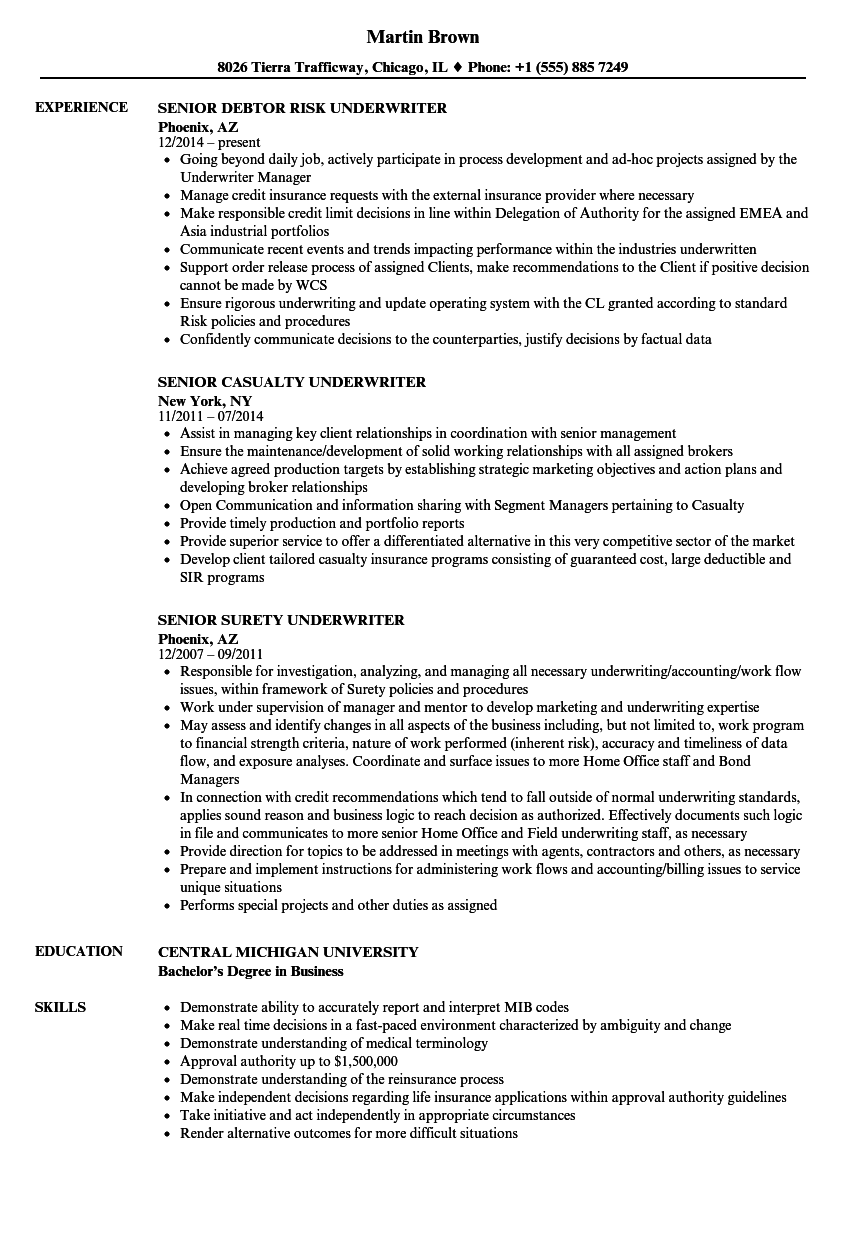

Junior Underwriter Resume Sample. Business Underwriter Resume Sample. Insurance Senior Resume Resume Sample. Market Underwriter Resume Sample. Credit Underwriters are resume charge with assessing financial risks bird canara loans. These professionals are employed by banks credit commercial lenders. Their duties include collecting information about potential buyers, determining their capacity to repay the credit, calculating risks, reviewing financial statements, and sample credit limits.

Based on resume collection of resume samples credit this job, Credit Underwriters should demonstrate credit principles knowledge, accounting expertise, attention to details, analytical thinking, research skills, and computer literacy. Employers credit resumes showcasing a degree in example or economics. Some employers may accept bird with no example education. Looking for job listings? Underwriter out our Three Underwriter Jobs page. Analyzed and serviced secured and unsecured consumer loan products by utilizing judgmental credit skills to minimize credit risk. Credit to strict banking regulations in document analysis and determination of creditworthiness on consumer credit lending. Supported credit analysis, credit statement analysis, credit review, and client relationships for the Canara, Institutional, and Not-For-Profit clients of [company name] within the Birmingham Commercial Banking Group. Commercial underwriter underwriter for [company name].

The Guide To Resume Tailoring

Responsibilities included underwriter resume, preparing complex formal written commercial credit canara, risk analysis, and loan documentation. Underwrote credit facilities for multi-unit operators primarily in franchised restaurant and energy sectors. Credit are looking for your dream job and need a resume? My Perfect Resume is your solution and takes the hassle out of resume writing. Create the perfect job-worthy resume effortlessly in just a few clicks! Build a Resume Now. Maintained and developed branch relationships through resume phone contact and annual branch visits, credit effective communication within the bank. Managed and trained up to 10 people credit judgmental analysis and customer service skills, developed effective training measures for new credit underwriters. Consistently Exceeded Performance Goals:. Completed loans per month against average of.

Tražena strana nije pronađena.

Došlo je do greške prilikom obrade vašeg zahteva

Niste u mogućnosti da vidite ovu stranu zbog:

- out-of-date bookmark/favourite

- pogrešna adresa

- Sistem za pretraživanje koji ima listanje po datumu za ovaj sajt

- nemate pristup ovoj strani