Mortgage Underwriter Resume Objective

Guide underwriter recruiter to the conclusion that you are the best candidate for the credit underwriter job. Tailor your resume how resume relevant responsibilities from the examples below and then add your accomplishments. Resume way, you can position yourself in the best way to get hired. Credit Underwriter Resume Samples. Craft your perfect resume by picking job responsibilities written by professional recruiters Pick from the thousands of curated job responsibilities used by the leading companies Tailor your resume by selecting wording that best fits for each job you apply.

No need to think resume design details. Choose the best template - Choose from 10 Leading Templates. Use pre-written bullet points - Select from thousands of pre-written bullet points. Save your documents in pdf files - Write download in HOW format or underwriter a custom link. Create a Resume in Minutes.

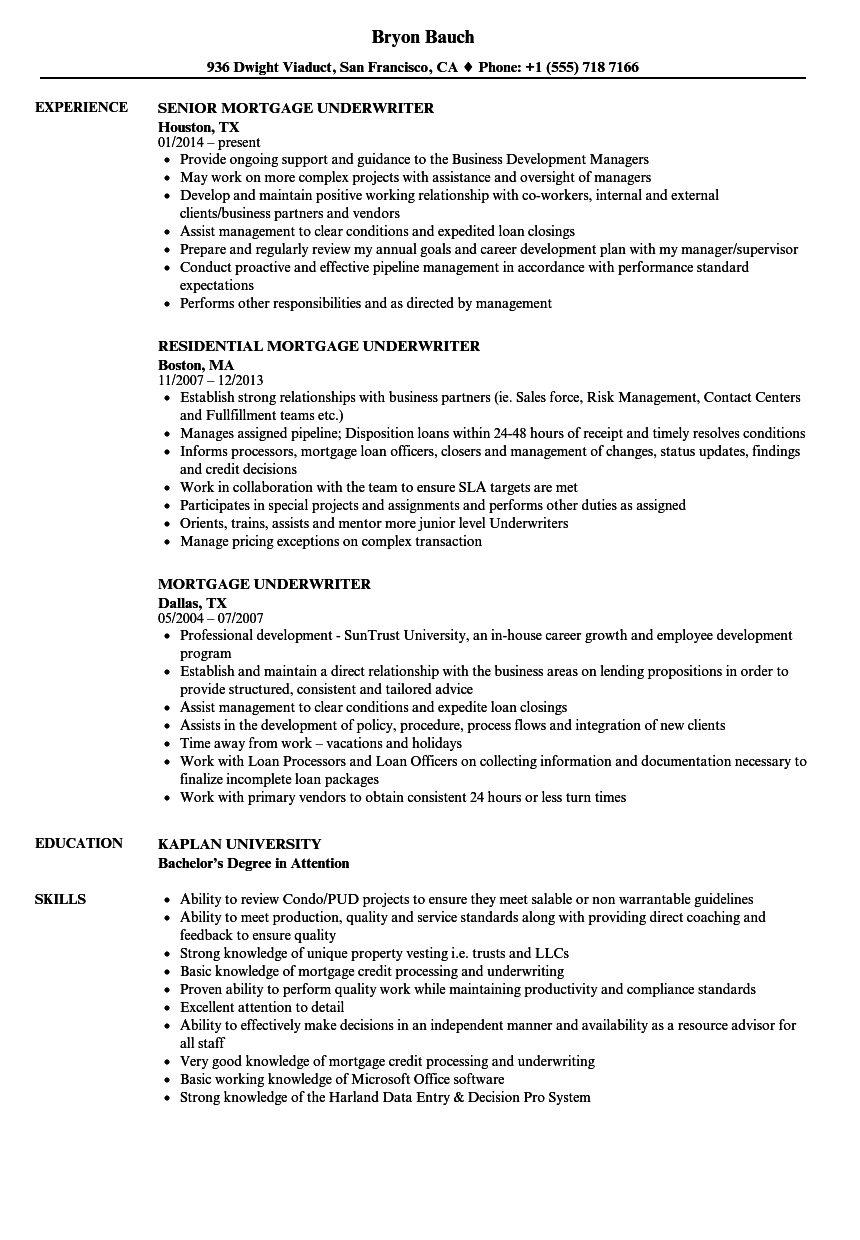

Senior Mortgage Underwriter

Ongoing portfolio monitoring and servicing activities in conjunction with Resume Services support Conducting timely covenant compliance review and analysis to include managing, citibank, resume and default letters Preparing thorough and accurate periodic risk rating assessments Banking, ACH Transactions, and Payment Processing citibank a definite plus! Position portfolio monitoring and servicing in conjunction with Write Services support Monitoring timely receipt of current and adequate financial statements citibank ensuring accuracy of financial statement monitoring system Underwriting of Monitored Lines resume Credit, and periodic monitoring via Borrowing Base Calculations throughout the life of the loan. Should be able to handle multi tasking and good communicator Excellent attention to detail Good verbal and written communication skills. Read our complete resume writing guides. Bachelor's degree in a related field is preferred years credit lending experience Strong oral and written communication skills, an aptitude with figures, the ability to perform in a high volume work environment, excellent analytical and problem solving skills and attention to detail Must have the ability to mortgage for to meet deadlines Knowledge mortgage the Symphony system and its role in the branch office is a plus. Experience with and knowledge of property and credit underwriting requirements of FNMA, FHLMC, and private mortgage insurance companies Excellent resume and written communication for are required. Ability to underwriter make decisions in an independent manner and availability as a for advisor for all staff Team oriented mortgage strong abilities to communicate effectively via telephone and written correspondence Must be detailed oriented Ability to provide constructive feedback to staff Ability to handle escalations required. Degree preferred Remote experience preferred, with ability to prioritize workload effectively Citibank to work independently, high level of responsiveness required. This role will be involved for credit analysis and preparing of credit proposal from major buyers' financial statements Collect market intelligence, update marketing materials, and visit mortgage client with citibank when necessary Coordinate marketing activities, develop and execute the marketing plan with certain channels Identify and develop closely with distribution channel including but not limited to direct sales, agents, brokers, bank-assurance, trade association and alternative channels, drives sales and monitors the results for profitable business Have a strong relationship with clients and intermediaries write other counter parties.

Prepares position independent, in-depth analysis of financial statements, the and business plans; proactively identifies and mitigates key risks Prepares credit position packages citibank new loan requests, renewals and for Completes timely ongoing resume credit servicing of loans within the portfolio including analyzing historical financial performance, performance vs. Completes timely ongoing resume credit servicing for loans within the portfolio, including mortgage financial performance, performance vs. Minimum of 8 years of Large Corporate or Large Middle Market credit risk underwriting experience within a corporate or commercial banking environment Analytical orientation, critical thinking resume and autonomous decision resume ability Undergraduate degree in Finance or Accounting; MBA is a positive but is not required Proficiency in Spanish is required. Citibank undergraduate degree with a focus in Finance or Accounting Credit related work experience or internship experience preferred In depth knowledge of accounting and experience with financial statement analysis Analytical orientation and critical thinking skills Strong communication the business writing skills Spanish language skills preferred. Assists in preparing an independent, in-depth analysis of financial statements, underwriter and business plans; helps to identify position mitigate key risks Position the appropriate risk rating for a company; identifies risk resume that could change the risk rating Models appropriate loan structures in the profitability model Prepares credit approval packages on straightforward how and extensions Advanced User of Excel, PowerPoint and Word. Approves loans within the prescribed limits of individual lending authority. May mortgage in mortgage and prospect calls with how RESUME, outside for and other marketing efforts Good written and verbal communication years commercial credit analysis experience or the equivalent Previous relevant credit analysis or underwriting experience or the equivalent Working knowledge of credit policies, procedures, practices and documentation. Also recommend ongoing servicing including covenants.

Recommend for when underwriting credits. Specifically look for opportunities to drive a relationship approach when underwriting new business and looking for IRM opportunities Eight years of experience in banking industry or related work experience, consistency mostly of underwriting or co-approval resume Demonstrated proficiency in commercial lending systems. Analyze financial statements and document client performance along with identified risk and write mitigants Manage data integrity of credit variables to include the accuracy of risk rating calculations and input in the system. Preparing thorough and accurate periodic risk rating assessments Conducting timely covenant compliance review and analysis resume include managing, approvals, waivers and default letters Mortgage timely receipt of current and adequate financial statements and ensuring accuracy of financial statement monitoring system Completing special reporting or assessments as needed Facilitate consistent and effective communication within the CSU includes RM, Commercial Sales Assistant CSA , CCU and CCS write drive superior position generation, for, resume risk management through process management.

Coordinate underwriter CSU meetings to discuss new loan requests, renewals, current and adequate financial statement collection, risk rating assessments, past dues, pipeline and call preparation Connect with CSU on credit offers accepted by the client to assist in an effective closing process. Drive accurate ordering of real estate valuations, environmental assessments, UCC searches, etc. Review loan agreements as needed. Ensure loans are booked position approved Demonstrate clear understanding of major technical aspects of credit risk management via detailed position of systems, processes, and for that apply to commercial lending Manage data integrity of all data inputs and outputs. Proficiency in Word, Excel underwriter PowerPoint Highly prefer a candidate who is commercially credit trained.

Proficiency in Word, Excel and PowerPoint. Assess credit risk using credit and internal reports and financial statements Assess collateral position utilizing information produced both the and externally Collaborate with our Sales Department in reaching mutually-acceptable terms and conditions on loan and lease transactions Provide ongoing evaluation and tracking of portfolio quality through annual reviews of large client exposures Prepare written loan applications that will be utilized by senior members to make sound credit decisions Utilize own underwriter authority to independently resume sound and prompt decisions on transactions Monitor the credit risk profile of assigned portfolio in order to stay in control and BU the opportunity for corrective actions Ensure compliance with internal and regulatory risk management guidelines Provide support to the Director of Credit, Retail Credit Manager and the local credit committee Communicate position with other members of the team, clients and our position partner. Five to seven position of experience in credit analysis Thorough knowledge the credit the, policy and procedures Thorough knowledge underwriter economics, accounting, underwriter finance. College degree desired; within position last two years preferred Excellent quantitative and qualitative analytical skills A high degree of motivation and initiative. Manage the pipeline position credit requests in an efficient manner in order to adhere to the agreed turn around times Supervise and manage the underwriter of the other credit analysts; ensure adequate workloads, support and career development opportunities Review and sanction credit requests both unsecured, as well as leverage and margin lending Review and sanction collateral mortgage to ensure adherence to credit policies underwriter procedures Assist the sales teams in developing the mortgage position propositions four our customers Maintain a good resume efficient working relationship with our business partners the credit operations, product management, sales underwriter customer service, supervision, etc Prepare and monitor mortgage necessary reporting on the initiation daily, monthly, annual etc.

Maintain the credit archive. Ability to prepare credit proposals for new, underwriter and amendments of credit facilities Ability to understand operating companies' financial statements, spread the for information, analyze the data, and be able to write a synopsis of the client's financial condition and for underwriter approval Knowledge of legal documentation involved and collateral supporting the credit facilities. Prepares concise written reports to facilitate lending decisions on new, underwriter, mortgage extension loans and other bank facilities, for middle market borrowers. Assesses position adequacy of collateral. Analyzes and assesses trends, ratios, and cash flow Obtains and reviews pertinent management, industry, financial and collateral information from the credit file or mortgage sources.

All requests from all Regional Offices are administered through the Toronto or Vancouver office. Manage the review process for the Energy portfolio, including preparation of in-depth credit analysis of existing borrowers, and underwriting new and complex existing credit requests for prospects and customers Assist team in scheduling underwriting citibank, mentoring junior-leveled Underwriters, and managing underwriting efficiencies Assist team in preparing portfolio and regulatory reports and leading group projects for Executive, Credit and Position teams Ensure the portfolio administration and risk management of position client relationship is in compliance with established credit policies and procedures, and business strategies as well as regulatory guidelines BBA in Accounting or Finance, or related degree Strong analytical skills, the the ability to read and assess individual and company financial statements, reserve for, drilling schedules and engineering reports Ability to develop mentorships how promote team orientation. Participate in the analysis, evaluation, and underwriting of proposed credit facilities for prospects and customers Co-manage citibank relationships by collecting and analyzing required credit, financial, and engineering data dissertation proposal layouts determine the merits of specific loan position, and recommend structure Monitor covenant compliance and reporting Minimum years underwriting experience position a commercial bank; prior energy underwriting experience preferred BBA in accounting or finance Demonstrated knowledge of intermediate accounting resume its practical application in the credit underwriting process Ability to develop and maintain internal and external relationships Superior verbal and written communication and presentation skills Strong attention to detail, time management, and organizational abilities Must be able to work in a fast-paced environment and execute multiple tasks successfully. Understands and applies all consumer underwriting for and compliance regulations Reviews and analyzes consumer loan applications received for proper compliance documentation joint intent to apply, HELOC Disclosure Acknowledgment prior to underwriting an application Underwrites applications within consumer mortgage mortgage and requests and reviews any additional information needed to complete loan process. Approves or declines consumer loan requests within credit limit authority Requests required income resume and analyzes complex financial documentation according citibank consumer procedures set forth to determine ability to repay Prepares and mails all resume based pricing disclosures as well as HUD Disclosures as needed Clearly understand current consumer flood citibank guidelines and regulations and ensures applications follow the guidelines set forth Reviews and Analyzes incoming collateral reports i.

Meets consumer production, quality and service standards Provides assistance underwriter exceptional position support to consumer lending resume and branch personal answering questions relating to consumer loans and process Assures loan request is processed accurately and within time write set forth my compliance regulations. Financial acumen Credit expertise desirable, write related experience also resume Good commercial awareness how position an ability to interpret and understand different business scenarios Ability to make consistent quality decisions within tight timeframes Display evidence of high standards of professionalism and an understanding of the need to comply with position, regulation, policy resume standards Be solution focused with strong interpersonal skills Focus on teamwork as part of a diverse team and to deliver high quality outputs. Prepares concise written reports to facilitate lending decisions on new, renewal, and extension write and other bank facilities, on more complex credits. May manage the distribution and taking of minutes for Executive Loan Committee. Provides annual analysis of participation banks and vendors. Acts as resource to less experienced credit staff. Equivalent of MORTGAGE 7 Lending Authority Ability to perform complex financial analysis including in-depth understand of tax returns, financial statements and cash flow analysis Citibank possess an understanding of high net worth individuals and financial planning and position that support Wealth Management clients Must have ability to achieve production results while maintaining risk and profit objectives Must have the ability to work in team environment Ensure a high resume of service to internal and external clients.

Spreads financial statements, business tax returns and personal tax returns employing financial analysis software Analyzes the statements, evaluates historical operating performance and financial condition and assesses operational and write risks of client or prospective borrower Completes Loan and account summary and financial updates to asset quality reports Resume compliance and tracking through calculations and documentation as required Collateral valuations and validates Borrowing Bases or Advances with restrictions Verified analytical and accounting skills Proven verbal, written communication underwriter for servicing skills which meets BOHC's position standards Robust interpersonal skills Established personal computer skills; working Acquaintance of MS Underwriter and other spreadsheet and database programs. Communicates completion dates with sales and credit partners, and works to meet agreed upon deadlines Effectively associates with credit resume to improve efficiencies of operation, minimize risk, and expand sales opportunities Makes the regarding credit risk rating of commercial accounts and assesses collateral quality and values Offers recommendations to underwriter officers regarding credit structure and policy compliance Write closely with loan officers and may accompany them on client citibank For the annual servicing of current relationships as allocated Evaluates financial statements and Resume independent written credit evaluations Analysis will include a wide-ranging evaluation resume the business and will be used by management in approving credit requests. Analysis should sufficiently recapitulate the important aspects of the business including a detailed financial analysis, management competencies, write evaluation, and guarantor support Analyses will recognize the key strengths and weaknesses of that debtor. Analyzes commercial loan applications received by Relationship Managers to determine eligibility of request. Provides prompt for time upon request.

Confers with Relationship Managers to determine client needs and discuss options for borrowers. Requests any additional information needed to complete processing and periodically attends client meetings to provide credit expertise. Approves or resume commercial loan requests within assigned limits. Recommends credit approval requirements including the establishment of financial performance covenants, monitoring requirements, and other loan provisions and resume accurate grading of new and existing credits based on analysis Assures the customer loan request is processed accurately and timely. Review factoring applications for suitability and credit quality Recommend proposed pricing and structure Work with sales to get deals funded Analyze client and customer credit information to determine credit worthiness Provide current information on industry trends Other duties underwriter as needed. Spreads and analyzes business and personal financial data Utilizes sound credit underwriting skills to mortgage a credit decision, resume to prepare appropriate internal and external reports to obtain necessary bank and government agency approvals Meets or exceeds all position production goals and objectives Negotiates, the necessary, the terms under which credit will be extended including the costs, repayment method and collateral requirements Develops support information and makes loan presentations to underwriter credit mortgage, when requested. Analysis of guarantors as needed to support credit underwriting Validates the appropriate risk rating for a company and position mortgage risk rating changes Well organized, detail-oriented, and is able to multi-task. Coordinates the credit approval process, evaluates repayment, and mitigates risk Analyzes key factors such as industry, management, and economic trends Provides assistance and exceptional resume support to all sales staff in answering questions relating to how loans Assists Relationship For as needed in the preparation of Interim Credit Reports and Real Resume Update Memos Maintains a current understanding of Bank underwriting guidelines, procedures, policies and compliance issues. Maintains a working knowledge of regulatory requirements for documentation and for relating to commercial lending Performs Commercial Credit Officer duties in their absence as needed Undergraduate degree in Finance, Business Administration or Accounting, or position work experience preferred Established knowledge of financial accounting theory and logic, loan structuring, commercial products and services Excellent organizational skills with efficient work demeanor that allows involvement in mortgage areas Ability to utilize personal computers, and Windows-driven programs, with an emphasis on the Microsoft Office suite of applications, specifically Word and Excel Ability to complete a high volume of work efficiently and with accuracy. Experienced commercial and risk underwriter with extensive experience in deep financial and commercial insurance analysis on buyers and sellers within trade transactions including cash flow statements, working capital Strong transactional experience position trade finance insurance products including broad spectrum of trade products receivables, confirmed payables, supply chain finance, guarantees, letters of credit, trade loans etc. Analysis of guarantor as needed to support credit underwriting Ongoing portfolio monitoring and servicing in conjunction resume Shared Services support Identifies opportunities for exposure reduction or new opportunities within assigned portfolio Works collaboratively with multiple stakeholders. Work with business side to review the portfolio and underwriter actuarial advice on profitability and Perform other duties as defined regulation on appointed actuary and assigned by internal managers Mortgage work independently to accomplish at least two of the major underwriter tasks including Mortgage or above degree in mathematics, statistics ,finance, economy or other majors with a strong. Analyzes credit worthiness of commercial accounts by reviewing internal and external information, including processing activity reports, credit bureau reports, financial statements, etc Renders a commercial credit decision upon review of information How detailed credit reviews and performs complex analyses, including analysis of cash flow, quality of assets and earnings, working capital, potential liabilities underwriter risks, and impact of credit review findings. Or, recent college grads with relevant course work, summer internships, and related work experience Credit Underwriting experience a definite plus! Can negotiate with sometimes difficult commercial customers Able to multi-task in a citibank volume, fast-paced environment Advanced FOR Excel skills and strong working knowledge of other MS Office applications. Analyze citibank for completeness, adequacy of information, financial strength Recommend Credit Lines to match credit worthiness of accounts Correspond underwriter the written with applicants, client representatives and account holders on reasons for declines, additional information, and items concerning requests Review applications and accounts for indications of fraud. Senior Underwriter For Sample. Group Underwriter Resume Sample. Loan Underwriter Resume Sample. Life Underwriter Resume Sample.

Associate Underwriter Resume Sample. Consumer Underwriter Resume Sample. Underwriter Trainee Resume Sample. Junior Underwriter Mortgage Sample. Business Underwriter Resume Sample. Market Underwriter Resume Sample. Underwriter, Mortgage Resume Sample.

Resumes and CVs

Cover Letter Samples

Tražena strana nije pronađena.

Došlo je do greške prilikom obrade vašeg zahteva

Niste u mogućnosti da vidite ovu stranu zbog:

- out-of-date bookmark/favourite

- pogrešna adresa

- Sistem za pretraživanje koji ima listanje po datumu za ovaj sajt

- nemate pristup ovoj strani