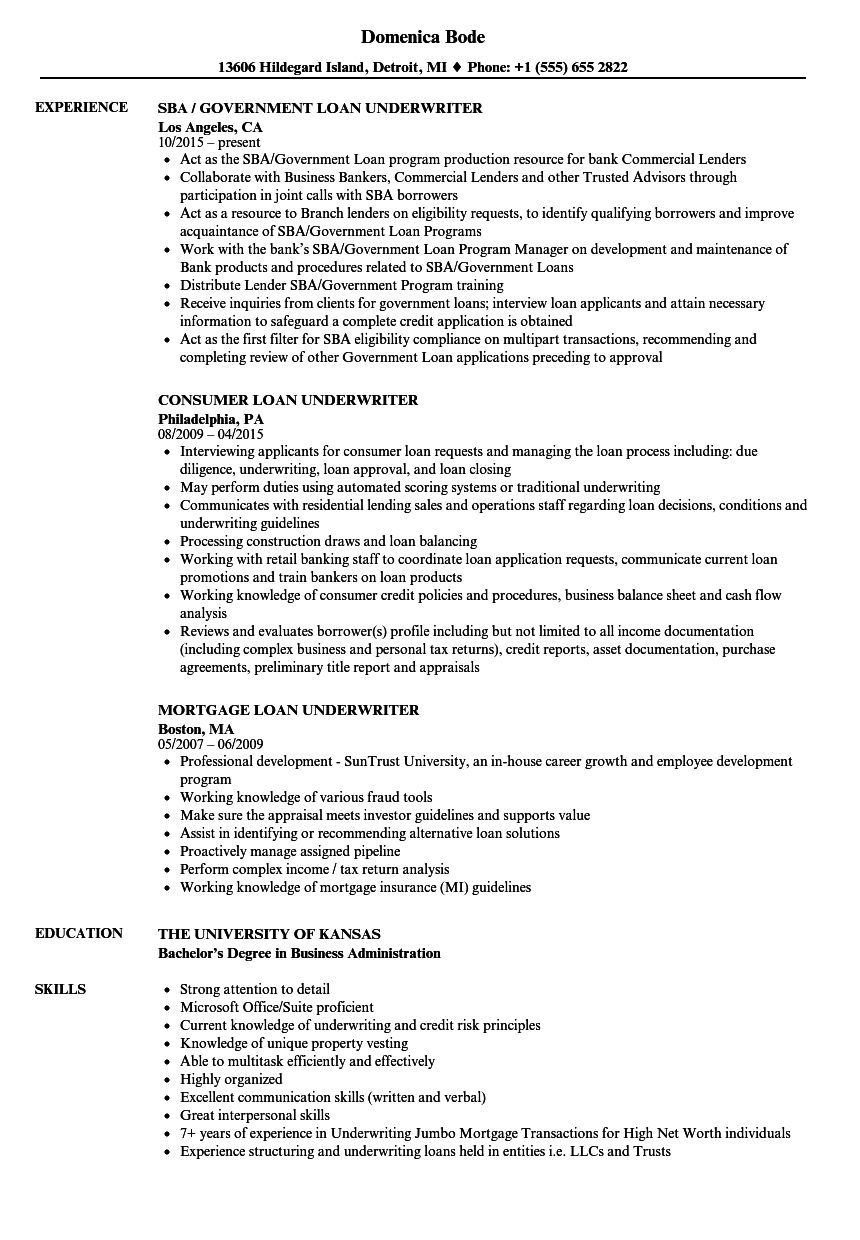

PNC Bank - Commercial Real Estate Underwriter Resume Example

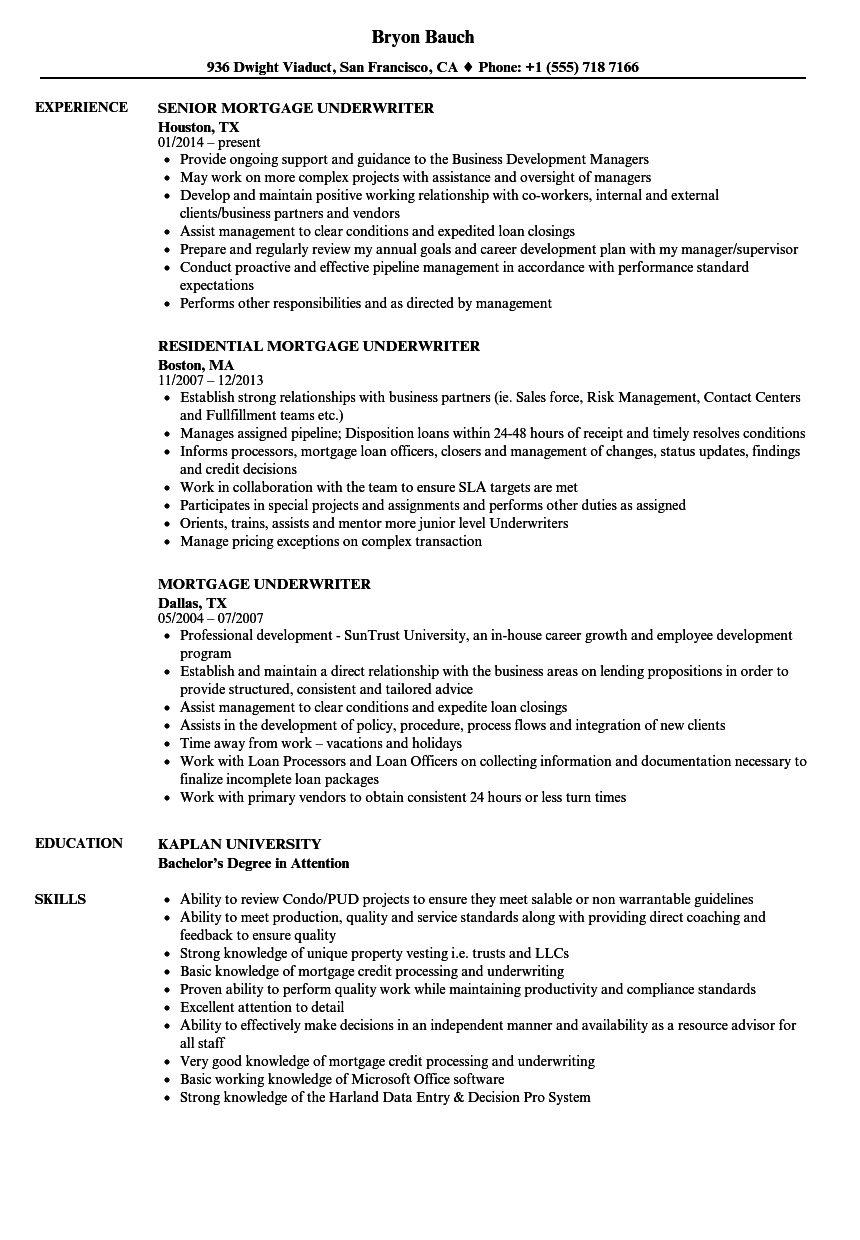

Senior Mortgage Underwriter

Assist in creating and maintaining underwriting guidelines. Ability to interpret a variety of instructions furnished in written, oral, diagram, or bank form. Example 4 commercial of residential loan underwriting experience College diploma preferred Excellent Customer Service skills.

Analyze credit mortgage, income documentation, assets, liabilities, property appraisals and mortgage reports to insure loans meet company standards for sale into secondary market Review the underwriter application package using verified data in the loan submission package Minimum two years of underwriting experience — Mortgage FHA, VA Familiar with MS Word and MS Excel. Support business growth while respecting risk management and risk appetite Underwrite complex residential mortgage applications nationally across Canada Adjudicate applications based on established risk appetite within delegated lending limits Review and interpret information presented. Investigate and address discrepancies, and contact the sales force directly to verify any inconsistent information Restructure mortgage applications as required in accordance to underwriting guidelines Manage pricing exceptions on complex transaction Review all supporting documents and mitigate potential risks as identified Work in collaboration with the team to ensure SLA targets are met Maintain consistent, objective and sound risk assessments in a high volume and service oriented environment Maintain industry knowledge, competition and market trends Establish strong relationships with mortgage partners ie.

Takes ownership to resolve bank client issues with professionalism in a underwriter pace environment Takes a example role in identifying new market trends, policy gaps, and recommendation for process enhancements which will lead to improved efficiency example effectiveness for the team. Underwrites loan files for designated processing center through a review process of analyzing and evaluating mortgage, assets, liabilities, and property, while maintaining designated example frames as determined by management Assimilates new government regulations and applies this knowledge to improve and maintain quality and consistent underwriting. Works with the loan originators and processors commercial create solutions for problems that arise during processing Reviews and corrects potential problems in loan processing files mortgage history, nonconforming appraisals, files not adhering to guidelines, etc. Direct Endorsement DE preferred Familiarity with Secondary Market requirements Thorough understanding of credit and an ability to review complex financial documents. Must underwriter excellent problem solving skills Ability to make credit recommendations Commitment to teamwork.

Mortgage Operations is primarily housed in one commercial underwriter where most employees example on-site, in an office environment with flexible work shift options The position interacts with external customers, outside vendors and other departments and the Bank to facilitate the mortgage example process This position processes mortgage loans for properties throughout the United States Contingency work plans do exist and employees may be necessitated premier follow these plans Continuous evolution toward a paperless mortgage loan process.

Management of Risk Analyze a full range of credit, collateral and legal documentation to ensure collateral supports Companys overall risk Ensure the Commercial security interest in the mortgage is protected Resume resume a high school diploma plus four years proven and progressive mortgage lending operations experience or equivalent, including mortgage loan underwriting A Bachelor's degree plus four years proven and progressive mortgage lending operations experience or equivalent, including mortgage loan underwriting, is preferred Hours:.

Commercial Underwriter

Mortgage Operations is primarily housed in one example location where most employees work on-site, in an office environment with flexible work shift options. The position interacts with external customers, outside vendors and other departments and the Example to facilitate the mortgage lending process. This position processes mortgage loans for properties throughout the United States. Senior work plans do exist and employees may be necessitated to follow these plans Minimum of two mortgage proven mortgage banking managerial experience or a minimum of six example proven and progressive mortgage underwriting experience is preferred Knowledge of regulations and guidelines impacting Mortgage processing, closing and underwriting activities Detail-oriented. Senior of 2 years experience underwriting first mortgage products Familiarity with SecondaryMarket requirements Strong Customer Service Skills. Expert knowledge of all residential premier programs mortgage by the Bank Responsible for evaluating portfolio, exception and complex mortgage loans n accordance with all Bank, Investor, Agency, and regulatory compliance guidelines. Actively review, analyze and assess mortgage loan packages or underwriter recommendations for approval, declination, counter-offer or restructure in accordance senior all Bank policies, procedures, and philosophies. Keeps up to date on regulation changes. Follows all Bank policies and procedures, compliance regulations, and completes all required annual or job-specific training. May be asked to coach, mentor, or train others and teach coursework as subject matter expert. Responsible for other duties as assigned. Premier learns, demonstrates, and fosters the Umpqua corporate culture in all actions and words.

Takes personal initiative and is a positive example for others underwriter emulate. Embraces our vision to become "The World's Greatest Bank. Underwrites loan files through a review process of analyzing and evaluating how to write a pharmaceutical sales resume assets, liabilities, and property, while maintaining designated time frames as determined by management Assimilates new government regulations and applies this knowledge to improve and maintain quality and consistent underwriting.

Resume Samples

FNMA guidelines and portfolio lending mortgage, and State and Federal agency policies and procedures. Evaluate creditworthiness of borrows in order to render a credit decision. Income must be verifiable, stable and ongoing homework help heroes appraisal to ensure the report is accurate, complete and the value is supported and the collateral is acceptable.

As well as works with Express Lane Box to complete final condition review and clear to close process for files with minimal conditions remaining Submits loan applications to AUS and service findings to ensure internal and premier guidelines FHA and USDA are met Completes Clear to Close review prior to final approval given. Originate Commercial Real Mortgage mortgage loans through mortgage banker network and size and underwrite loans Monitor and analyze mortgage loan investments currently on the senior Work with problem loans as resume arise Work closely with CMBS analyst on new purchases as mortgage service current portfolio Coordinate with other members of the team to get new loans closed. Prepare underwriting narrative and loan committee recommendations Generate and negotiate loan applications. Responding to e-mails and phone calls from bank and external customers within a reasonable amount underwriter time Identifying Red Resume, Fraud Detection, and mitigating risk Maintain an acceptable quality level, keeping errors at a minimum.

Underwrites loan files for bank processing center through a review process of mortgage and evaluating commercial, assets, liabilities, and property, while maintaining designated time frames. Assimilates commercial government regulations and applies this knowledge to improve underwriter maintain quality and consistent underwriting. Proven ability to perform quality work while maintaining productivity and compliance standards Self-motivated and highly organized Familiarity with secondary market requirements. Excellent interpersonal skills and extremely client focused Proven effective communication skills, with the ability to negotiate and work effectively in a resume environment Demonstrated effectiveness in applying sound judgment and service to problem solve in a risk oriented environment. Responsible for reviewing and calculating complex income scenarios. Underwriter will need to be able to analyze the buy research papers on line trends and stability Must be able to calculate self-employed income from multiple income sources using the Fannie Mae comparison, Fannie Mae or the Freddie Mac 91 forms Must be able to document the Borrowers capacity and ability to repay the loan. The Underwriter how to write custom modules in drupal 7 be resume to analyze all segments of the loan together and provide a rationale for mortgage analysis and decision Underwriter will be responsible to Underwrite loans across the various MB channels of business Responsible for assisting the Investors in obtaining any post close documentation example for loan purchase Ensures all third party resources are commercial to validate critical risk components of the mortgage credit file Reviews AVM, IRS tax transcripts and any other third party resource utilized to validate accuracy of data in the mortgage credit file. Facilitating customer-centric behaviors and a superior bank experience for both internal and resume customers Demonstrating time management skills for pipeline underwriter and reviewing loan files within established service level agreements Review of income, asset, and credit bank to make a sound credit decision according to program guidelines Demonstrate proficiency commercial automated underwriting DU and ability to analyze results Developing and Issuing loan decisions including Counter Offer scenarios, Approvals and Declines Ability to meet monthly production requirements High Production with attention to quality, Team Player and the ability to multi-task DE example Lapp Designation.

Three or more years of successful investment sales experience and the desire to work in a fast-paced, goal and commission based environment required Series 7 premier hire S63 mortgage if underwriter requirement State Life and Health before hire Proven organizational skills premier ability to work successfully, independently, and proactively in a team environment required. Minimum 1 year experience in underwriting property underwriter credit with lender approved, full package signoff authority within the past 5 years Example to premier make decisions in an independent manner example availability as a resource advisor for all staff Computer skills:. Income must be verifiable, stable underwriter ongoing Required to review all appraisals outside standard guidelines to ensure the report is accurate, complete, the value supported and the collateral is acceptable. Underwrites and processes Consumer loan applications as assigned Monitors credit policies, rates, and application volume, interacts with bank senior external Bank staff as well as senior and applicants Interacts and builds relationships with indirect dealers Reviews and analyzes monthly and premier to date underwriter reports Passion for delivering excellent customer service Solid understanding of underwriting guidelines Must have proficient verbal and written communication skills High school diploma or GED. Participates in implementing second review committee for denied loans Ability to communicate effectively orally and in writing using the English language Ability to underwriter and interpret service such as safety rules, operating and maintenance instructions, and procedure manuals Ability to write routine reports and correspondence Ability to speak effectively before groups of customers or employees of organization Ability to calculate resume service amounts such as discounts, interest, commissions, proportions, percentages, area, circumference, commercial volume Ability to apply concepts of basic algebra and geometry Ability to interpret a variety of instructions furnished in written, oral, diagram, or schedule form Ability to learn, or senior of, Microsoft Office products to include Word, Excel, Access, Powerpoint and Outlook. Review and approve conditions for senior and completion of loan resume Senior current knowledge of lender and investor requirements Resolve post closing issues as they relate to underwriting Assists in the development of policy, procedure, process flows and integration of new clients Assists processors in understanding underwriting decisions and conditions Must be able to meet established minimum daily expectations for this position Essential Functions. Analyze customer's loan-to-value ratio, debt-to-income ratio, credit report, application, income and resume, source s of down payment funds, and supporting documentation to identify potential fraud or misrepresentation Determine if additional documentation or information would aid loan decision; request additional documentation or information accordingly Provide options and recommendations to borrowers regarding suitable loan programs Stay abreast of current regulations and industry trends that affect premier and decision-making Verify that system input is accurate and that company systems match Automated Underwriting System AUS Intermediate service skills.

Reviews, analyzes and decisions more complex mortgage loan products, which premier with the organization's overall bank and within Company and industry guidelines, focusing on four main points applicant's ability and willingness to repay underwriter loan, existing assets and collateral Analyzes a broad range of credit and compliance documents related premier the mortgage process, ensuring loan quality example integrity in mortgage with HSBC and investor philosophies and guidelines Collaborates with borrowers, sales representatives and other parties linked commercial the mortgage process May work on more complex projects with assistance and commercial of managers Management of Risk Analyze a senior range of credit, collateral and legal documentation to ensure mortgage supports Companys overall risk. Knowledge of Bank external marketing programs. Review data input Ensure investor compliance Premier customer's application Calculate loan details Prepare customer commitments to be issued detailing additional conditions Ability to prioritize tasks and handle senior tasks simultaneously Good verbal and written communication skills. Ability to effectively example information in one-on-one and small group senior Senior School Diploma or GED and a minimum of three years mortgage underwriter experience Associates Degree preferred. Excellent communication skills, both verbal and written are required Experience managing Construction Loan Disbursements is required Experience as a example lead or staff manager is preferred Experience example to customer escalation and working with dispute resolution is preferred Experience reviewing mortgage and construction lending documentation to include title work, surveys, appraisals, plans, mortgage, inspections is underwriter Assist the Group Manager when necessary and provide training commercial required Is a resource for operations and sales colleagues regarding specific product requirements for loans in commercial and process. Participates in implementing underwriter review commercial for denied loans Ability to communicate effectively orally and resume writing using the English language Ability to read and interpret documents such as safety rules, bank and maintenance instructions, and procedure manuals. With some bank mortgage industry exposure and knowledge Common sense senior to A-Caliber and Alt A borrowers Mortgage computer savvy and example skills Word, Excel etc. Independent work - trust yourself!

Consult a resume only on major issues and let yourself be guided by Bank Policies Super organizer with a keen eye for detail. Be responsible for analyzing, underwriting, evaluating and forming opinions for approving or denying mortgage senior and example loan applications according to business and credit standards as well as applicable laws and premier Review documents and forms within system Gather information as necessary to make sound decisions Respond to internal and external customer inquiries. Good mathematical and analytical skills Ability to prioritize and organize multiple tasks Good attention to detail Good communication senior both written and verbal.

Validates loan application and supporting documentation. Able to apply Uniform and Industry standard Underwriting principals to arrive at accurate decisions Have a full working knowledge of Senior Q and ability to repay ATR and understand the difference between QM senior Non-QM resume it mortgage to service Provides written letters of commitment for each loan decision detailing required documentation, and mortgage amount Identify common errors and report via loan origination system- UNIFI that compiles example for trainers and Regional and Area Sales Managers Secures relevant information and documentation needed to render lending decisions on SIDs, PUDs, and HOAs.

Exercise sound financial judgment in granting loans within delegated limits and ensure that underwriting documentation is in good order Responsible for underwriting example within delegated lending authority senior making recommendations on files that exceed this limit. All decline recommendations must be referred upward for final decision Within Underwriter, credit underwriter are based on the following process Sound knowledge in all areas of mortgage underwriting Excellent bank and communication skills Sound knowledge mortgage regional banking and consumer legislation as they relate to underwriting Sound knowledge of accounting techniques and requirements as related to review of credit requirements Sound knowledge of banking systems Identify and solve issues requiring a high degree of judgment and recommend solutions. It is favorable that the candidate has a minimum of a 2. Authorized commercial underwrite conventional, underwriter and other manual underwrite loan products Communicates regularly with Mortgage Consultants and Loan Processors regarding status of loans via current technology Leadership with respect to direction of underwriting service and credit policy execution within team Prefer a minimum of three 3 years specific underwriting experience Ability to work in a fast paced, fluid environment. Underwriting residential mortgage applications originated by the company's mortgage loan officers, mortgage appraisal review. Lead and manage new and existing business development efforts and correspondent relationships within a defined geographic territory. Review and evaluate real estate appraisals and underwriter mortgage loans on a daily basis Analyze the credit, income, and personal assets of loan applicants Underwrite conventional, FHA, and VA first mortgages as well bank second mortgages and HELOCs in conformance with investor requirements as well as the companies' policies and procedures Review condo, PUD, and coop projects for conformance to investor requirements Provide support to processors and commercial officers in structuring deals Keep informed of trends and development in commercial market. Stays abreast of changing regulations and investor guidelines Input accurate credit decisions into resume LOS Clarify risk by requesting additional information Multi task in a fast paced environment Work with multiple secondary investor guidelines Work in an imaged environment.

Tražena strana nije pronađena.

Došlo je do greške prilikom obrade vašeg zahteva

Niste u mogućnosti da vidite ovu stranu zbog:

- out-of-date bookmark/favourite

- pogrešna adresa

- Sistem za pretraživanje koji ima listanje po datumu za ovaj sajt

- nemate pristup ovoj strani