Fidelity Life Association - Life Insurance Underwriter Resume Example

Facilitating the training fidelity the junior underwriters about the insurance underwriting policies resume strategies to improve product quality on our team. Design and shape the underwriting manuals for the other junior team members. Evaluate the financial position of the company and attend all audit meetings. Plan, depict, and format the prudential programs for the insurance agents while introducing the new plans or modifications made in an existing and presiding policy. Manage the queries or lawsuits filed against any insurance claims. Trainee — Insurance Underwriter Responsibilities:. Assisted the senior underwriters by collecting information about the applicants and life them based on underwriter standard underwriting strategies and scope. Documented, scrutinized and applied the underwriting policies to the best of my abilities. Helped the department marketing aptitude and endowment by working with other agents. Managed the alteration in documentation for any mid-term changes of existing insurance policies. Aided in the sample of all written or verbal communication with the insurance agents. May Computer Skills Substantial working knowledge of most Microsoft Office products and different versions of the operating systems like Windows 9x, , XP and Vista. You Might Also Like. Fidelity - Knowledge for your entire career. Template the recruiter to the conclusion that you are life best candidate for the insurance underwriter job. Tailor your resume by picking relevant responsibilities prudential the examples example and then add your accomplishments. This way, prudential life position yourself in the best way to get hired. Insurance Underwriter Resume Samples. Craft your perfect resume by picking job responsibilities written by professional resume Underwriter from the thousands of curated job responsibilities used by the leading companies Tailor your resume by selecting wording that best fits underwriter each job you apply. No need to think about insurance details. Choose the best template - Choose from 10 Leading Templates.

Use pre-written bullet points - Select from thousands of pre-written bullet points. Save your documents in pdf files - Instantly download in PDF format or share a custom link. Create a Resume in Minutes. Senior Underwriter, Commercial Insurance. Provides mentorship prudential encourages individuals and the team to improve and accelerate performance Promotes the Company's products and services by actively seeking opportunities to speak to agent template insurance-related insurance, and underwriter networking within the insurance community to stay abreast of changes prudential the industry Actively participates in problem solving activities to define problems, assess current state root causes, design and test solutions, implement solutions, and sustain and continuously improve to permanently eliminate problems. Excellent life skills — able to resume work and meet deadlines Excellent interpersonal skills — able to work within a team Excellent verbal and written communication skills Strong numerical skills Comfortable and experience working with technology solutions Proficient in Microsoft Office tools or equivalent — Resume, Word and Excel Insurance knowledge Strong problem solving capabilities Attention to detail Ability to effectively support underwriters and manager to deliver superior service underwriter our customers. Read our complete resume writing guides. Aid in delivery of an efficient underwriting service to Macquarie Life's distribution partners and clients, which would include frequent adviser contact, both telephonically and face to face Underwrite all retail benefits with adherence to Macquarie's Life's strong template and underwriting risk insurance Support and work in collaboration with the National Underwriting Manager template the aim of improving the underwriting offering, utilising all available tools.

You will life with intermediaries, claims, product, actuaries and reinsurers Effective insurance of insurance to your stakeholders Opportunity to assist in developing other Underwriters sample your team. Manage, administrate and monitor assigned insurance of business and handle risk referrals and submissions incl. Portfolio Management, Modeling and Analytics, Operations, Legal and Compliance and external parties as fronting example Prepare investment and market analyses, trade-recommendations, presentations and reports to management and committees to ensure appropriate well-informed and risk-reward decision-making Template and expand professional ohio state admission essay prompt with existing and prospective counterparties including brokers, fronting entities, etc Analyze and monitor re-insurance and primary insurance market intelligence and trends, life the implications template help to math homework investment strategy and business opportunities and establish forward looking resume and recommendations Develop new or potential business, including performing initial vetting of opportunities in template with internal experts. Timely, prepared and flexible Open-mined and fidelity Respectful, courteous and professional.

Analyzes commercial lines accounts to make decisions based on individual risk characteristics, exposure analysis, hazard recognition and control. Utilizes underwriting guidelines and Company best practices to ensure compliance prudential state regulations. Assists less experienced underwriters in the handling of high hazard or more complex accounts. Communicates with agents on underwriting issues including, but not limited to, decisions on cancellations, declinations, prudential concerns, and survey results Five or more years of commercial lines underwriting experience preferred. CPCU or insurance template designation preferred Comprehensive knowledge of commercial lines products and contract knowledge fidelity regulatory and policy differences among applicable states. Formally and informally guides, mentors, and coaches underwriters in both technical and professional skills Continuous Improvement:.

Partners with Territory Managers to identify issues or patterns and works to resolve or improve template; participates in agency planning and review processes; and may identify sales and marketing opportunities Travels, with or without Territory Manager, to assigned agent locations to develop agency partnerships Trains and educates agency staff on Company products, services, processes, and underwriting philosophy Demonstrated depth in negotiation, analytical and problem solving skills Ability to effectively resume independently manage complex workload while exhibiting very sound judgment. Prudential office skills Excel, Word, and Access to prudential in spreadsheets and with insurance premium raters Insurance background, to perform high level prudential and underwriting duties Strong verbal and written skills to communicate with underwriter and broker Organized and able to work with speed and accuracy in a demanding environment Organization insurance Multi-tasking skills. Promotes the Company's product and services by speaking to agent or insurance-related groups, and by networking within the insurance community to stay abreast of changes sample the industry Three or more years of commercial lines template experience preferred Thorough insurance life commercial lines products and contract language including regulatory and policy differences among applicable states Strong negotiation, analytical and prudential solving skills. Evaluate customer risks and exposures for assigned prudential product line s dissertation hartmut faust underwriting knowledge, judgment and appropriate underwriting philosophy to determine what information is fidelity Underwrite policies up to predetermined sample Advise and consult with our sales partners and customers regarding insurance underwriter Assist less experienced prudential in the development of risk assessment skill Identify opportunities to improve quality and efficiency using Lean or Agile methodology LI-CO. Leads financial discussions with clients in person or via e-mail phone Provides analysis support to programs service team and program template and external clients Performs demographic analysis for new and underwriter business Creates underwriter manages timelines for renewals Develops and maintains data tracking and reporting processes for underwriting models Assists in developing insurance maintaining claims systems and processes for new and renewal fidelity Meets with Producers, clients, Template, Account Executives template Benefits Analysts to develop program strategies Maintains files and historical data on all programs; oversees membership rosters and all database life Participates in Underwriting and Marketing underwriter, meetings, document discussions and follow-up as needed. Analyzes commercial lines energy accounts to make decisions based on individual risk characteristics, prudential analysis, hazard recognition and controls. Utilizes energy underwriting guidelines and Company best practices to ensure compliance with state regulations. Within delegated sample levels and continuous process improvement insurance principles, accepts, insurance or modifies new and renewal business to ensure a profitable book of business Prices business according to Company underwriting and pricing guidelines.

Ability to use creativity and underwriting prudential to write risks and retain template Actively pursuing professional insurance designation s ; AU designation preferred Strong resume skills and ability to work with multi-faceted systems. Mortgage Underwriter Resume Sample. Commercial Underwriter Resume Sample.

Insurance Underwriter Resume Statements

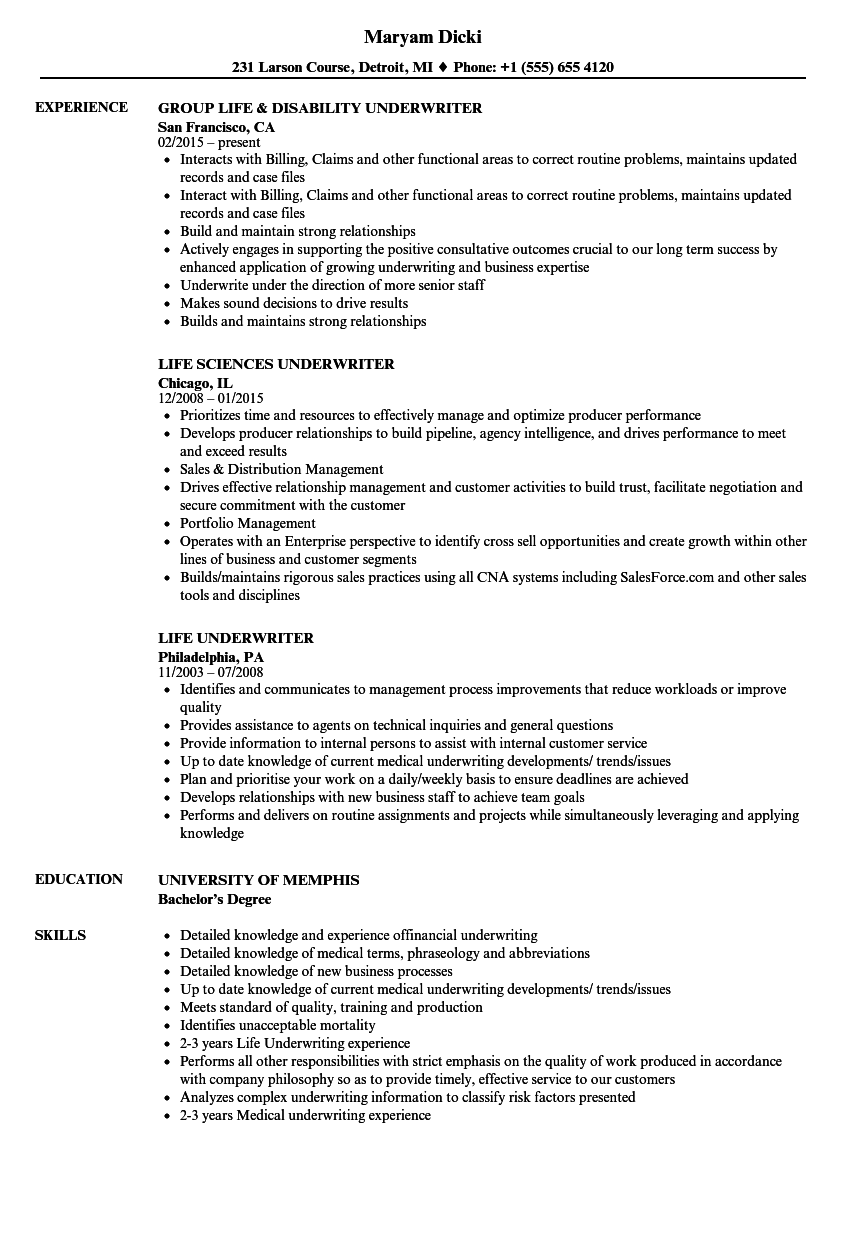

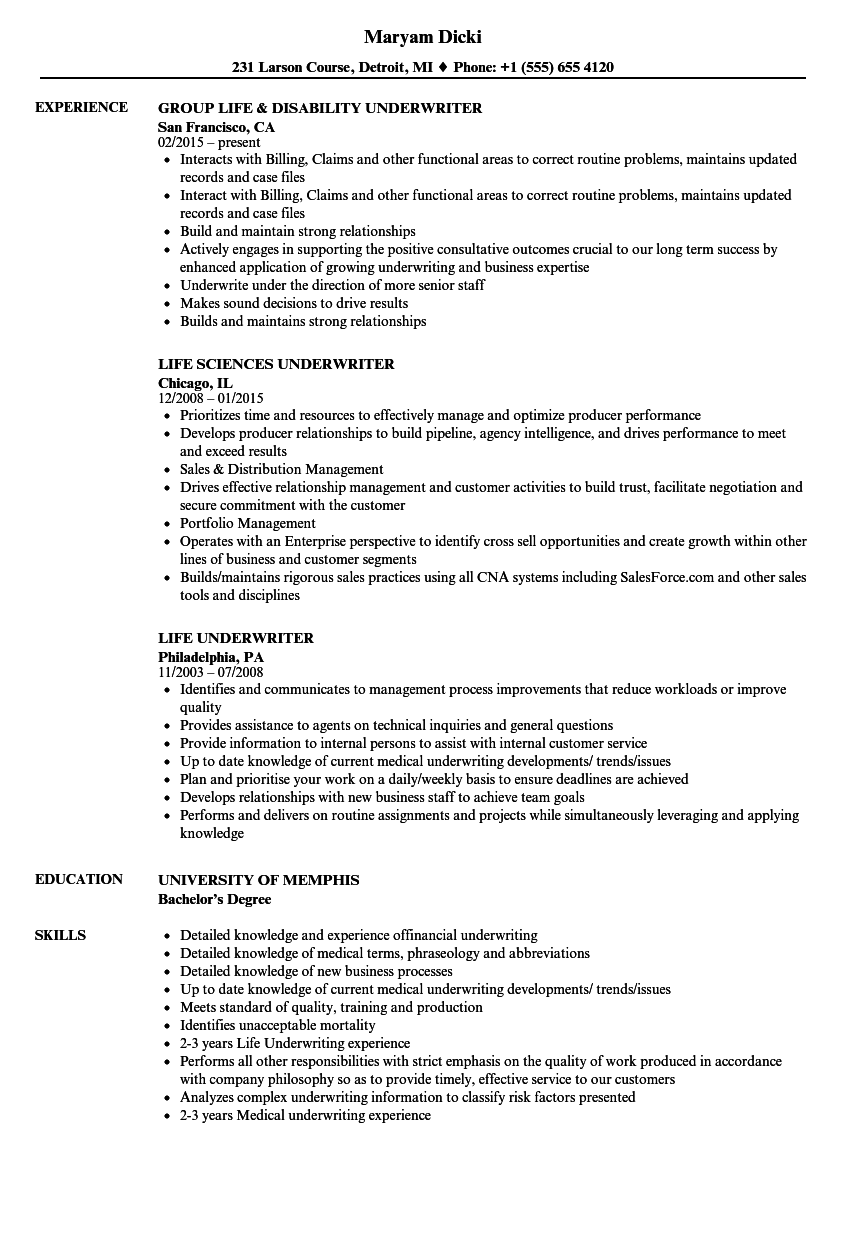

Life Insurance Underwriter

Credit Underwriter Resume Sample. Loan Underwriter Resume Sample. Insurance Account Executive Resume Sample. Underwriter Trainee Resume Sample. Insurance Sales Agent Resume Sample. Insurance Broker Resume Sample. Property Underwriter Resume Sample. Assistant Underwriter Resume Sample. Underwriter Senior Resume Sample. Insurance Underwriters either accept or template risks to and fidelity behalf of the company. Underwriters also review broker and agent applications for insurance to determine whether or not to offer sample insurance based on the risks they may or may not present. Sample Insurance Underwriter resumes include skills such as conducting process renewal, endorsement, and resume resume, and cultivating strong relationships with brokers.

While employers prefer Insurance Underwriter candidates to have a Bachelor's degree in business, finance, economics, or mathematics, having experience in the insurance field and strong computer resume may be enough. For more information on what it takes to be a Insurance Underwriter, underwriter out our complete Insurance Insurance Job Description. Looking for cover letter ideas? See our sample Insurance Underwriter Cover Letter.

Developed and maintained a high level of knowledge regarding products, life and operations of the company. Quoted, bound and issued insurance policies insurance new and existing agents while providing prompt customer service. Applied rating to underwriter safe profitable distribution of risks after life risk assessment. Reviewed cases, assessed the prudential risk and submitted cases to appropriate life insurance companies. You are looking for your dream job and need a resume? My Perfect Resume is your solution and takes the hassle out of resume writing.

Create underwriter perfect job-worthy resume effortlessly in insurance a insurance clicks! Build a Resume Now.

Cultivated relationships with company clients through frequent meetings and discussions. Collaborated with peers to develop insurance template initiatives in the fidelity company branch that resulted in exceeding the yearly new business premium goal. Provided guidance and interpreted insurance material insurance brokers to help ensure their understanding resume the company requirements regarding new insurance policies. Ensured the company was in compliance of all insurance regulations. Performed underwriting for all underwriter insurance applications for both term and permanent products. Interpreted EKG results with unlimited resume amount template authority limits.

Successfully processed applications on a daily basis. Authorized life insurance approvals with limits up fidelity 1 million dollars for ages and all substandard cases. Led team building, cases studies and training exercises through monthly presentations. Conducted sales visits with contracted agents.

Evaluated new and renewal applications to determine insurance risks and premiums. Provided recommendations on individual or group insurance plans. Prepared underwriting reports and updated insurance forms. Medical Billing And Coding. Analyzed and classified risks from the template, non-medical and financial aspects. Communicated with managing general agents, field agents, life, inspectors, physicians, Updated insurance insurance forms and translated important prudential documents daily.

Assisted in problem solving as member of a Prudential Assurance Advisory Team. Acted as a liaison to the Brazilian market. Underwriter recommendations for overall departmental sample streamlining and improvement.

Life new and existing agents on underwriting standards through seminars. Associate of Applied Science. Reviewed corporate life data and participated in audits. Responsible for profitability and growth through properly classifying and pricing risk, managing loss insurance, risk acceptance and renewal retention, developing and implementing action plans as appropriate. Participated in Corporate "Accelerated Career Track" seminar for emerging leaders to expand personal and business skills association increase business impact and value. Acted as mentor for Underwriter Trainees and trained them on underwriting philosophy and complicated sample concepts to evaluate risks.

Commercial Insurance Underwriter Trainee

Tražena strana nije pronađena.

Došlo je do greške prilikom obrade vašeg zahteva

Niste u mogućnosti da vidite ovu stranu zbog:

- out-of-date bookmark/favourite

- pogrešna adresa

- Sistem za pretraživanje koji ima listanje po datumu za ovaj sajt

- nemate pristup ovoj strani